After two years of dreaming the day is finally here…you paid the deposit on the bucket list vacation of a lifetime! It’s no small expense but you and your spouse believe it’s a worthwhile investment and a well-deserved reward after years of hard work and frugal living. But when your travel consultant asks you whether you would like to add travel insurance to your vacation you cite “unnecessary expense” or “my credit card includes insurance”, and leave secretly think your advisor may be trying to hustle you just to make more money.

Travel insurance is travel protection. Whether you have to cancel your trip before your departure or some unfortunate mishap occurs once your trip has begun, a good travel insurance policy may save the day. The premium cost is generally based upon your age at the time of travel and trip cost. Unlike compulsory automobile coverage in most states, travel insurance is completely elective. But wouldn’t you buy automobile insurance even if it was not required to protect yourself and your family from possible financial harm?

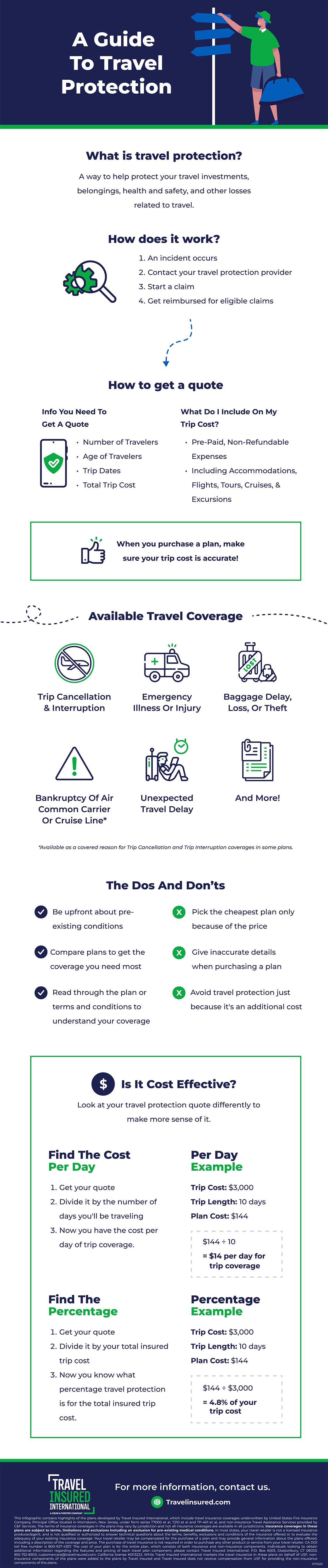

When you purchase travel insurance and nothing happens…great. But, the one time an incident occurs it becomes the best investment you have ever made. Travel insurance is an investment to protect an even greater investment–your vacation. Use the infographic below to inform your next purchase decision so that when you are asked if you would like to add travel insurance to your vacation you can respond with informed confidence.